Basic Cover 300 is our entry level product which is sufficient in providing for Gap cover, Casualty cover and a separate Oncology Gap cover benefit.

R99 p/m

R180 p/m

R360 p/m

The Basic Cover 300 option covers up to 300% above medical aid scheme tariff.

This means that if your service provider charges anything up to 3 times what your medical aid will cover, TRA will provide for this GAP, subject to the annual limit.

*Annual Limit: The Basic Gap, Casualty and Oncology Gap benefits are subject to the aggregate gap cover annual limit of R198 660 per insured person per annum. (This limit may change due to regulatory amendment).

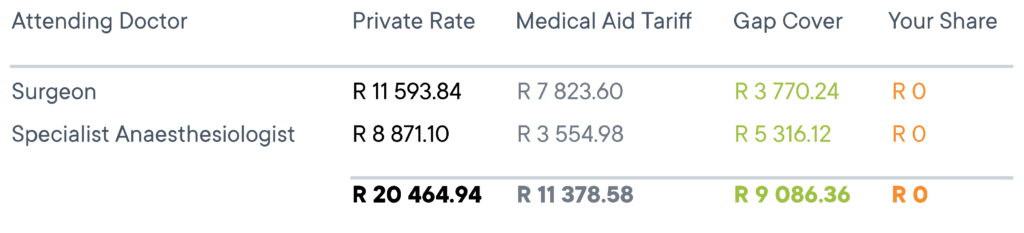

Michelle saved R 9086.36.

By choosing Basic Cover 300, you can too.

Your medical aid, just like Michelle’s, may not cover 100% of the private rate of the medical practitioner, resulting in a shortfall payment due from you.

Eliminate the financial worry from the stress of a hospital operation or stay.

Attending Doctor

Surgeon

Specialist Anaesthesiologist

Private Rate

R 11 593.84

R 8 871.10

R 20 464.94

Medical Aid Tariff

R 7 823.60

R 3 554.98

R 11 378.58

Gap Cover

R 3 770.24

R 5 316.12

R 9 086.36

Your Share

R 0

R 0

R 0

TERMS AND CONDITIONS APPLY

Michelle saved R 9086.36.

By choosing Basic Cover 300, you can too.

Your medical aid, just like Michelle’s, may not cover 100% of the private rate of the medical practitioner, resulting in a shortfall payment due from you.

Eliminate the financial worry from the stress of a hospital operation or stay.

TERMS AND CONDITIONS APPLY

Michelle saved R 9086.36.

By choosing Basic Cover 300, you can too.

Your medical aid, just like Michelle’s, may not cover 100% of the private rate of the medical practitioner, resulting in a shortfall payment due from you.

Eliminate the financial worry from the stress of a hospital operation or stay.

Attending Doctor

Surgeon

Specialist Anaesthesiologist

Private Rate

R 11 593.84

R 8 871.10

R 20 464.94

Medical Aid Tariff

R 7 823.60

R 3 554.98

R 11 378.58

Gap Cover

R 3 770.24

R 5 316.12

R 9 086.36

Your Share

R 0

R 0

R 0

TERMS AND CONDITIONS APPLY

Michelle saved R 9086.36.

By choosing Basic Cover 300, you can too.

Your medical aid, just like Michelle’s, may not cover 100% of the private rate of the medical practitioner, resulting in a shortfall payment due from you.

Eliminate the financial worry from the stress of a hospital operation or stay.

Attending Doctor

Surgeon

Specialist Anaesthesiologist

Private Rate

R 11 593.84

R 8 871.10

R 20 464.94

Medical Aid Tariff

R 7 823.60

R 3 554.98

R 11 378.58

Gap Cover

R 3 770.24

R 5 316.12

R 9 086.36

Your Share

R 0

R 0

R 0

TERMS AND CONDITIONS APPLY

Gap Cover is an insurance policy that covers the difference between what your medical aid pays and what service providers charge for in-hospital expenses.

Claims – Manual and Automatic Processes

The policyholder is responsible for ensuring that claims are submitted and received by TRA within six (6) months from the treatment date. The policyholder should also ensure that TRA has the correct banking details into which we must pay the claim.

Claims – Manual Process

Policyholders need to submit the following:

Claims – Automatic Process

TRA receives claims submitted by selected medical aid schemes on behalf of the policyholder. Should your medical aid company have such an agreement with TRA, it is optional for the policyholder to submit their claim to TRA.

TRA will receive an electronic version of the claim and will process the said claim within seven working days of receipt thereof.

Co-payment and sub-limit claims must always be submitted manually by the policyholder (in addition to all the required claims documentation, please also provide proof of any direct payment/s made to these service providers).

Should a claim be rejected because additional information (e.g. pre-authorisation letter, medical aid statement, doctor’s account or the first two pages of the hospital account) is not received, all the information must be submitted to TRA within 31 days from the date of the request or the claim will be rejected as late/stale in terms of this policy and will not be paid.

Most people purchase medical aid and assume they will take care of all their medical bills. Unfortunately, this is not always true. Medical shortfalls can occur if you need medical care for any reason – accident or illness. You don’t want to add financial worry to the stress of being hospitalised, which is why you need Gap Cover.

Gap Cover ensures you don’t receive a massive bill if there’s a shortfall between what the doctors charge and what your medical aid will pay for in-hospital procedures.

The country’s elite swimmers gathered in Port Elizabeth last week for 6 days, at the Swimming South Africa Senior National

Navigating medical cover can be challenging, especially when you are preparing for your new addition to the family. One of

The TRA Executive Head for Communications, Public Relations and Training, Warren Gates caught up with Matt Sates slogging it out at the High-Performance Centre at University of Pretoria.

16 Jersey Drive, Longmeadow

Business Estate East

16 Jersey Drive, Longmeadow

Business Estate East

16 Jersey Drive, Longmeadow

Business Estate East

Copyright © 2023. | Terms and Conditions Apply. | Errors and Omissions Excepted.

Copyright © 2023. | Terms and Conditions Apply. | Errors and Omissions Excepted.